This is an archived post

[glenn]December 18, 2021, 12:30am

Hello DerivaDex Community,

I wanted to create a topic in the forums to share a proposal ![]()

![]() Bancor Governance Forum – 15 Dec 21

Bancor Governance Forum – 15 Dec 21

Proposal: Whitelist DerivaDAO token (DDX) Plus 100K BNT Trading Liquidity

This proposal is expected to appear on Snapshot for voting on 2021-12-19T13:00:00Z (UTC) . Make sure to stake your vBNT for voting before this date and time to participate in the DAO decision. TL;DR Proposal to whitelist DerivaDAO Token (DDX)…

Reading time: 1 mins ![]() Likes: 2

Likes: 2 ![]()

that I brought forth in the Bancor DAO to whitelist $DDX with 100K $BNT trading liquidity. This will allow $DDX holders to stake in the DDX-BNT pool (if the proposal passes) single-sided and also receive impermanent loss protection. The 100K $BNT trading liquidity means that with $BNT at a price of ~$3 that this will open up roughly $300K of DDX staking capacity and if the pool fills up completely then it will be roughly $600K in depth.

The proposal is set to go live for voting in the Bancor DAO on Sunday (12/19/21). It would be great for any DDX community members to show support for this proposal. Note, if you are a $BNT holder (have voting power in the Bancor DAO) you can vote on snapshot when this goes live.

For anyone not familiar with Bancor, there are two key features that differentiate it from other DEXes:

- Single-Sided Exposure: LPs can provide liquidity to a pool with single-sided exposure, either in an ERC20 token (“TKN”) or in BNT.

- Impermanent Loss Insurance: Impermanent Loss Insurance accrues over time, by 1% each day, until 100% protection is achieved after 100 days in the pool. There is a 30-day cliff, which means that if a liquidity provider decides to withdraw their position before 30 days passes, they’d incur the same IL loss experienced in a normal, unprotected AMM. If an LP withdraws any time after 100 days, they receive 100% compensation for any loss that occurred in the first 100 days, or anytime thereafter.

1 Like

[glenn])December 27, 2021, 8:20am

The proposal is now live on snapshot:

and results seem promising so far:

Note that 35% quorum and 66.7% supermajority is required for this proposal to pass.

[glenn]January 14, 2022, 3:33pm

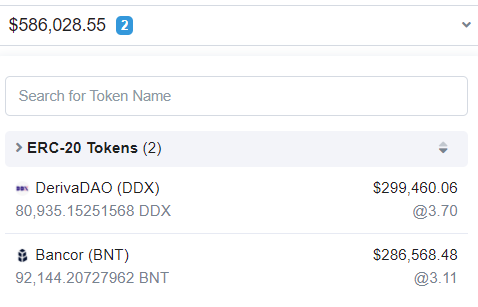

The proposal passed two weeks ago successfully and the entire pool on Bancor was filled up completely in a matter of hours:

It is now the deepest pool as compared to other DEXes on Ethereum.

[glenn]January 14, 2022, 3:34pm

I have recently proposed a trading liquidity increase for this pool and also a change in fees:

![]() Bancor Governance Forum – 14 Jan 22

Bancor Governance Forum – 14 Jan 22

Proposal: Increase Trading Liquidity to 300K BNT on DDX (DerivaDAO) Pool and…

This proposal is expected to appear on Snapshot for voting on 2022-01-16T12:00:00Z (UTC). Make sure to stake your vBNT for voting before this date and time to participate in the DAO decision. TLDR This proposal seeks to increase the trading[…]

the new proposal should go up for vote on Sunday 1/16/22.

1 Like

[glenn]January 26, 2022, 6:11am#5

Closing the loop here, the proposal passed and the pool is now the deepest out there:

there is currently no more single-sided IL protected capacity remaining but if there is interest from the community in growing the liquidity here then we can certainly increase it in the future.

2 Likes

[Maximo3453]January 27, 2022, 3:36am

I would be interested for that👌

1 Like